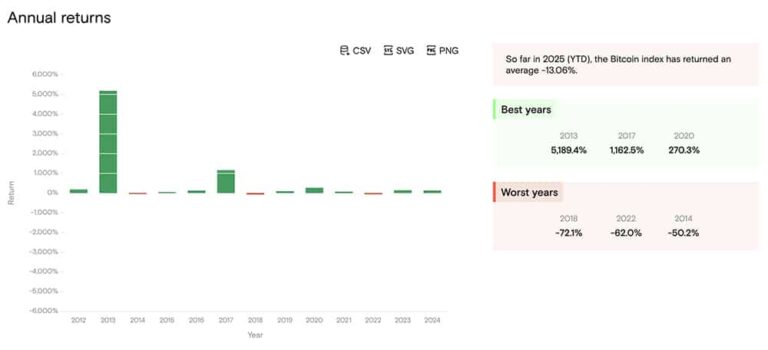

The market shows stability on this Boxing Day, with major assets maintaining positions amid low holiday volume. A massive $27 billion in Bitcoin and Ethereum options expire today on Deribit, marking one of the largest events on record. This settlement could clear hedging pressures that have constrained Bitcoin within $85,000 to $90,000 for much of December, opening paths for renewed movement and possibly the next 100x crypto.

Bitcoin trades steadily above $88,600, aligning with user-reported levels and showing resilience in thin conditions. Ethereum approaches $3,000 again, currently near $2,962 as per recent data. Solana remains around $122, while Uniswap climbs to $5.95, contributing to positive weekly results in decentralized exchange tokens.

Meanwhile, Lighter, a decentralized perpetual trading protocol, builds anticipation for its token generation event expected soon, following strong funding and volume growth.

DISCOVER: 10+ Next Crypto to 100X In 2025

Year-End Liquidity and Post-Holiday Expectations – Hunting the Next 100x Crypto

Without a notable Christmas rally, attention turns to the close of 2025 and the absence of further major holidays. Traders anticipate possible fresh capital inflows as trading resumes fully, potentially aiding momentum into January. The options expiry today may reduce mechanical barriers, allowing underlying demand from ETFs and institutions to influence prices more directly.

REMINDER:

More than $23B in $BTC options expires today. pic.twitter.com/UAtO07ix6i

— Gerla (@CryptoGerla) December 26, 2025

DISCOVER: Why Bitcoin Price Can’t Clear $90K Even With “Perfect” Inflation

In calmer periods, emerging projects gain traction for substantial growth potential. Tokens in DeFi perpetuals, zero-knowledge scaling, and high-volume trading platforms attract focus for rapid gains. Initiatives like Lighter, with its Ethereum Layer-2 design and recent institutional backing, highlight opportunities in verifiable on-chain execution. Spotting the next 100x crypto involves assessing adoption metrics, liquidity depth, and innovative features in an evolving landscape.

The concluding days of 2025 reflect a consolidation stage, bolstered by ongoing ETF inflows and corporate interest. As normal trading volumes return, both established assets and promising newcomers stand to benefit from renewed participation.

Stay tuned for the latest crypto news.

Trust Wallet Hack Drains Over $7 Million in User Funds

On Christmas Day 2025, hundreds of Trust Wallet users reported sudden and unauthorized drains from their crypto wallets, totaling more than $7 million in losses across chains like Ethereum, Bitcoin, Solana, and BNB Chain. The Trust Wallet hack is only the latest incident in a long line of exploits this year, with hackers becoming steadily more aggressive in their approach.

The incident was first flagged by prominent on-chain investigator ZachXBT, who issued an urgent alert on Telegram after receiving multiple reports of funds vanishing without user approvals. “Hundreds of Trust Wallet wallets have been hacked in the last 2 hours,” ZachXBT warned, later estimating initial thefts at over $6 million based on tracked addresses. He noted the drains coincided with a recent update to the wallet’s Chrome browser extension.

AAVE’s Ongoing Governance Drama: The “Civil War” Heats Up

AAVE, a leading DeFi lending protocol, is embroiled in a heated governance dispute dubbed the “Aave Civil War” between Aave Labs (led by founder Stani Kulechov) and the AAVE DAO token holders.

The conflict centers on control over brand assets, domains, social media, and revenue streams from frontend integrations like CoWSwap.

A recent snapshot vote on token alignment ended with the DAO losing (55% Nay vs. 41% Abstain), amid accusations of rushed timing during holidays and lack of consultation. Critics claim Aave Labs unilaterally pushed the proposal, while Stani defended his $15M AAVE purchase as personal conviction, not for voting.

Undeterred, the DAO plans a revote in January, highlighting tensions over who truly owns the protocol’s IP and future. Stani pledged clearer economic alignment, noting the DAO’s $140M earnings this year.

Solana’s USX Stablecoin Experiences Brief Depeg Amid Liquidity Crunch

The Solana-based stablecoin USX faced significant volatility in secondary markets, dropping to $0.1 due to a sudden liquidity drain. Solstice Finance confirmed that underlying assets remain fully collateralized above 100%, with no internal issues.

The team is injecting liquidity to stabilize prices and has requested a third-party attestation. One-to-one redemptions are available in the primary market. PeckShieldAlert reported the peg has recovered to $0.94, highlighting the incident’s temporary nature.

We are aware of some major volatility in the secondary market for USX tonight.

The Solstice team can confirm the underlying NAV and the custodied assets backing USX on the Solstice side remain entirely unaffected and >100% collateralized. We have requested an immediate and…

— Solstice (@solsticefi) December 26, 2025

Lighter Shares Source Code After Audits, Enabling Full On-Chain Verification

Lighter has revealed that following audits on its perpetual and spot systems, it now shares the source code for validating all on-chain actions, such as orders, cancellations, and liquidations. This step boosts openness and confidence, enabling public checks on Lighter’s Layer-2 functionality and Ethereum security.

$154 Billion in Crypto Liquidations: How to Avoid It and What to Do

2025 has been a brutal year for us in crypto, with $154 billion wiped out just from this year’s total liquidations alone. This massive loss of course came from those using way too much leverage, overleveraged. There were some big triggers, like the October 10th flash crash that saw more than $19 billion liquidated.

If we are to stay in crypto, we need to know how to avoid this kind of loss in the future.

Total crypto market cap: $3 trillion

Total liquidations in 2025 alone: $150 billionBefore gambling on futures again, ask urself:

Do you really want to donate your hard-earned money to greedy, extractive exchange and MM pockets?

Futures are the biggest cancer of this industry. pic.twitter.com/VBdye7nUcp

— 𝗰𝘆𝗰𝗹𝗼𝗽 (@nobrainflip) December 25, 2025

The post Crypto News Today, December 26 – Record $27B Options Expiry Today as Bitcoin Price Holds Above $88K: Next 100x Crypto? appeared first on 99Bitcoins.