BlackRock, the world’s largest asset manager, has launched its first Bitcoin exchange-traded product (ETP) in Europe.

The new iShares Bitcoin ETP (IB1T) gives investors easy access to bitcoin through a regulated and secure investment vehicle. This is BlackRock’s first bitcoin-linked ETP outside North America, following the success of its U.S.-listed iShares Bitcoin Trust (IBIT) which has over $50 billion in assets.

Related: BlackRock’s IBIT Sets Record as “Greatest Launch in ETF History”

The iShares Bitcoin ETP is available to trade on Germany’s Xetra exchange and Euronext Paris under the ticker IB1T and on Euronext Amsterdam as BTCN.

It’s designed for both institutional and retail investors, providing a secure way to get exposure to bitcoin without the hassle of direct trading and storage.

Manuela Sperandeo, head of iShares Product for Europe and Middle East said:

“It reflects what really could be seen as a tipping point in the industry—the combination of established demand from retail investors with more professionals now really getting into the fold.”

To attract investors, BlackRock is waiving the initial fee by 10 basis points, reducing the expense ratio to 0.15% for the rest of the year. After the promotional period, the fee will go up to 0.25%, which is still competitive against other European Bitcoin ETPs like CoinShares’ $1.3 billion product.

BlackRock’s ETP is physically backed by bitcoin, meaning actual bitcoin is held in reserve to support the investment. Custody of these assets is managed by Coinbase Global Inc., a leading exchange known for its cold storage solutions.

The ETP is structured through a special-purpose vehicle in Switzerland, benefiting from the country’s investor-friendly regulations and tax advantages.

The European bitcoin ETP market is smaller than the U.S. but growing. There are over 160 digital-asset-related ETPs trading on European exchanges with more than $13 billion in assets. BlackRock’s entry into this space will further boost adoption and liquidity.

Jane Sloan, EMEA head of global product solutions at BlackRock said: “With 25 million cryptocurrency investors across Europe, we believe ETPs have an important role to play to build a bridge between crypto and traditional finance through their efficiency and convenience.”

BlackRock has been the leading player in the European exchange-traded product market for years with iShares having a 42.6% share worth over $1 trillion. This launch is part of the company’s plan to expand its customer base in the region from 9 million to 19 million in the next three years.

Unlike in the U.S. where spot bitcoin ETFs in early 2024 brought a big surge in demand, Europe has had digital asset ETPs for years.

But regulatory uncertainty held back growth. The EU’s MiCA regulations have brought much-needed clarity and Europe is now more attractive to institutional players like BlackRock.

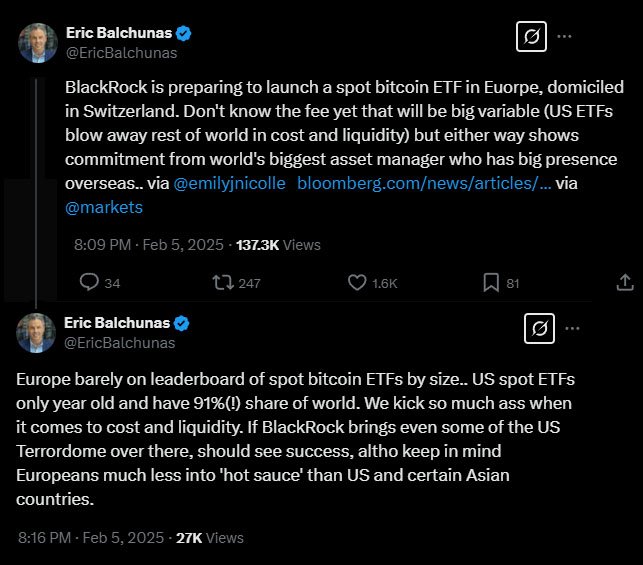

Bloomberg analyst Eric Balchunas said while Europe’s bitcoin ETP market is still small compared to the U.S., BlackRock could change that.

“If BlackRock brings even some of the US Terrordome over there, [it] should see success, although […] Europeans [are] much less into ‘hot sauce’ than US and certain Asian countries,” he said.

Bitcoin investment products are seeing renewed interest, with U.S.-listed bitcoin ETFs bringing in $644 million in net inflows after a period of outflows. BlackRock’s IBIT led the way with $538 million in one week.