Hyperliquid JELLY token saga with Binance, OKX listings shakes DeFi and crypto trading. HYPE drops 10%—what’s next?

Clashes are nothing new in crypto, and yesterday, everyone was closely monitoring events pitting Hyperliquid, a popular decentralized futures exchange, against Binance and OKX—two of the world’s largest centralized exchanges that want to maintain their hegemony over crypto perpetual trading.

JELLY Versus Hyperliquid: What’s Going On?

At the heart of this saga was a low-market-cap Solana meme coin, Jelly, which skyrocketed by over 300% within hours, nearly triggering a catastrophic $230 million liquidation for Hyperliquid.

The two-day event, starting on March 25, exposed vulnerabilities in DeFi, specifically Hyperliquid—which is not new to controversy—and raised more questions about whether decentralized protocols are as decentralized as they claim to be.

Hyperliquid aims to change how crypto traders place positions away from centralized platforms. The platform has its layer-1 chain and is fast, processing tens of thousands of transactions every second. It is all in a low-fee environment with a smooth interface rivaling Binance, Coinbase, and Bybit.

Over the months, Hyperliquid has processed over $1 trillion in trading volume, sometimes exceeding $2 billion in average daily volume. What sets it apart is that the platform is designed to ensure liquidity by taking passive positions while paying liquidity providers from revenue and liquidations.

The Crisis Explained: Why Did Hyperliquid Crash?

This design became the lynchpin of this crisis, looking at what one nefarious trader chose to do on March 25.

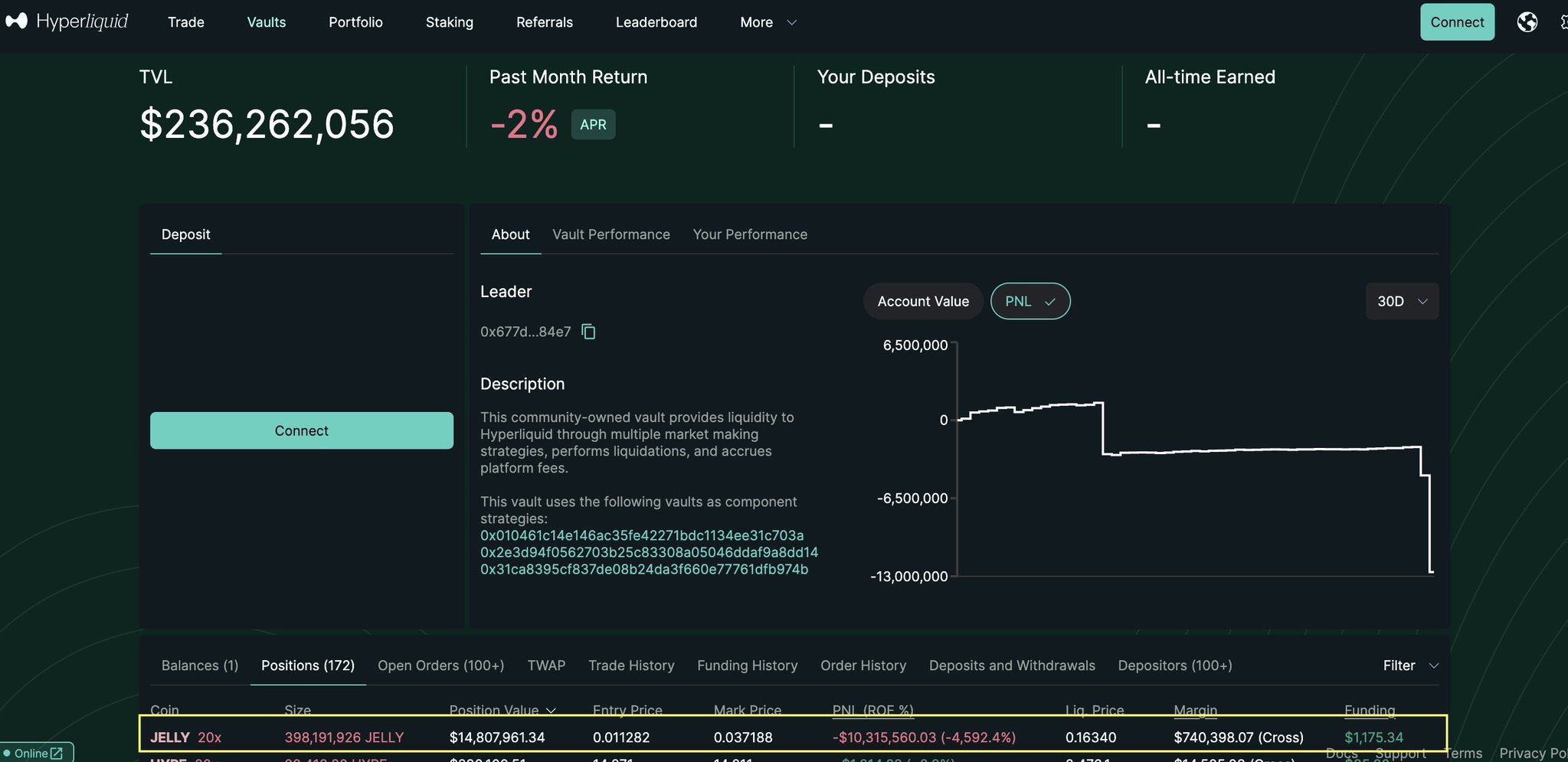

Targeting the JELLY vault on Hyperliquid, he dumped 124.6 million JELLY worth around $4.85 million, crashing prices and forcing the vault to automatically inherit a massive 398 million JELLY short position worth $15.3 million.

While he shorted on JELLY on Hyperliquid, the trader simultaneously took a long position on Binance, pumping it from $0.0095 to $0.050, a 426% surge. The spike on Binance led to a short squeeze on Hyperliquid, meaning the vault and liquidity providers on the protocol held a $12 million unrealized loss.

If JELLY prices continued rising, pumping to a market cap of over $150 million, then the JELLY vault on Hyperliquid could have been liquidated, causing massive losses.

Did Binance and OKX Want To Bury Hyperliquid?

Binance and OKX wanted this because as Hyperliquid tried to manage this clear price manipulation, they listed JELLY on their perpetual futures platform, aiming to cause more distress to liquidity providers on Hyperliquid.

By listing, JELLY prices rose, with market cap peaking at $50 million before retracing to around $25 million.

However, Hyperliquid became decisive in managing this crisis.

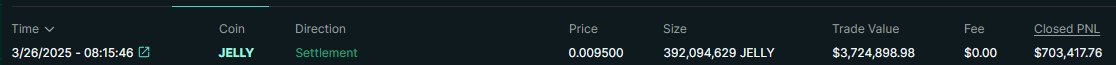

Not only did its validators vote to delist JELLY perpetual, but it also closed all positions at $0.0095—the price point at which the short trader had initiated its huge short. By doing this, they automatically converted a $12 million unrealized loss into a $700,000 profit.

(Source)

Hyperliquid also said it would reimburse liquidity providers except for price manipulators. While this was welcomed, HYPE prices fell sharply, sliding 10% in the last 24 hours, per Coingecko.

(HYPEUSDT)

HYPE Falls As More Questions Raised

The sell-off was due to the fierce backlash from the community.

Arthur Hayes, the co-founder of BitMEX, said Hyperliquid was centralized. In his view, HYPE prices would fall, underperforming some of the best Solana meme coins to buy in 2025.

Let’s stop pretending hyperliquid is decentralised

And then stop pretending traders actually give a fuck

Bet you $HYPE is back where is started in short order cause degens gonna degen

— Arthur Hayes (@CryptoHayes) March 26, 2025

Meanwhile, Bitget CEO said delisting JELLY was “immature, unethical, and unprofessional.” In her view, this may be the beginning of another FTX 2.0 trust crisis.

#Hyperliquid may be on track to become #FTX 2.0.

The way it handled the $JELLY incident was immature, unethical, and unprofessional, triggering user losses and casting serious doubts over its integrity. Despite presenting itself as an innovative decentralized exchange with a…

— Gracy Chen @Bitget (@GracyBitget) March 26, 2025

Nonetheless, supporters of Hyperliquid accused Binance and OKX of amplifying volatility and capitalizing on its distress.

The timing of the JELLY listing was too convenient. Onchain analysis shows the trader moving funds from Binance, OKX, and MEXC.

Moreover, Hyperliquid, acting swiftly and liquidating the short at the entry point, managed to avert risks, protecting its users from absorbing a $230 million liquidation.

The HyperLiquid $JELLY situation is a lesson for CEX replacement onchain DEXs that we need more resilience for things like this.

Unlike most people shitting on HL right now for how they handled the situation, I actually support their decision. Most will say its centralized, 3… pic.twitter.com/6bbfTG7M3c

— Elite Crypto (@TheEliteCrypto) March 27, 2025

One user of X said this was not a betrayal of DeFi principles but “effective crisis management.”

BREAKING: HYPERLIQUID FLIPPED A $12M DISASTER INTO PROFIT

this wasn’t just a liquidation—@HyperliquidX turned a black hole into profit while @binance got caught in the crossfire.

bought in? see why this is one of defi’s most controversial moves. pic.twitter.com/d1lJ9Vhhum

— trippie₊ (@kriqtay) March 27, 2025

DISCOVER: Next 1000x Crypto – 10+ Coins That Could 1000x in 2025

Hyperliquid JELLY Token Drama: Binance, OKX Listings Rock DeFi and HYPE

- JELLY Token Pump: Prices rally after manipulation attempt.

- Binance-OKX Listings: An attempt to bury Hyperliquid?

- Crisis management raises questions on decentralization

- HYPE prices crash 10%

The post Hyperliquid vs. Binance and OKX: JELLY Trading Rocks HYPE and DeFi appeared first on 99Bitcoins.